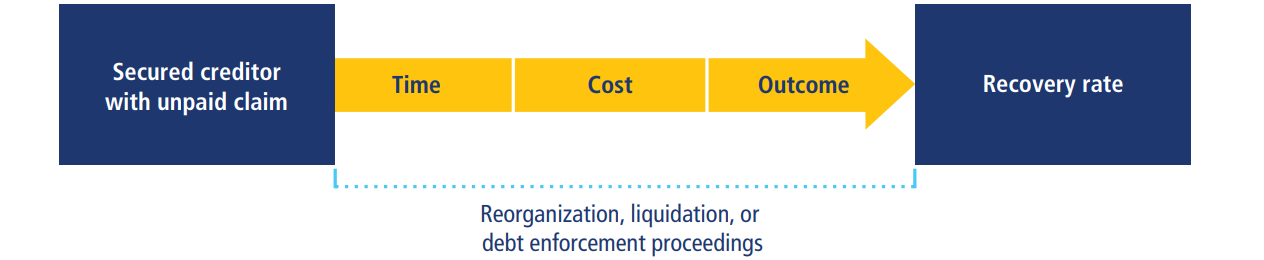

Doing Business studied the time, cost and outcome of insolvency proceedings involving domestic legal entities. These variables were used to calculate the recovery rate, which was recorded as cents on the dollar recovered by secured creditors through reorganization, liquidation or debt enforcement (foreclosure or receivership) proceedings. To determine the present value of the amount recovered by creditors, Doing Business used the lending rates from the International Monetary Fund, supplemented with data from central banks and the Economist Intelligence Unit. The most recent round of data collection for the project was completed in May 2019. See the methodology and video for more information.